ITT’s Businesses and Key End Markets

Click here for ITT’s Investor Overview deck to learn more.

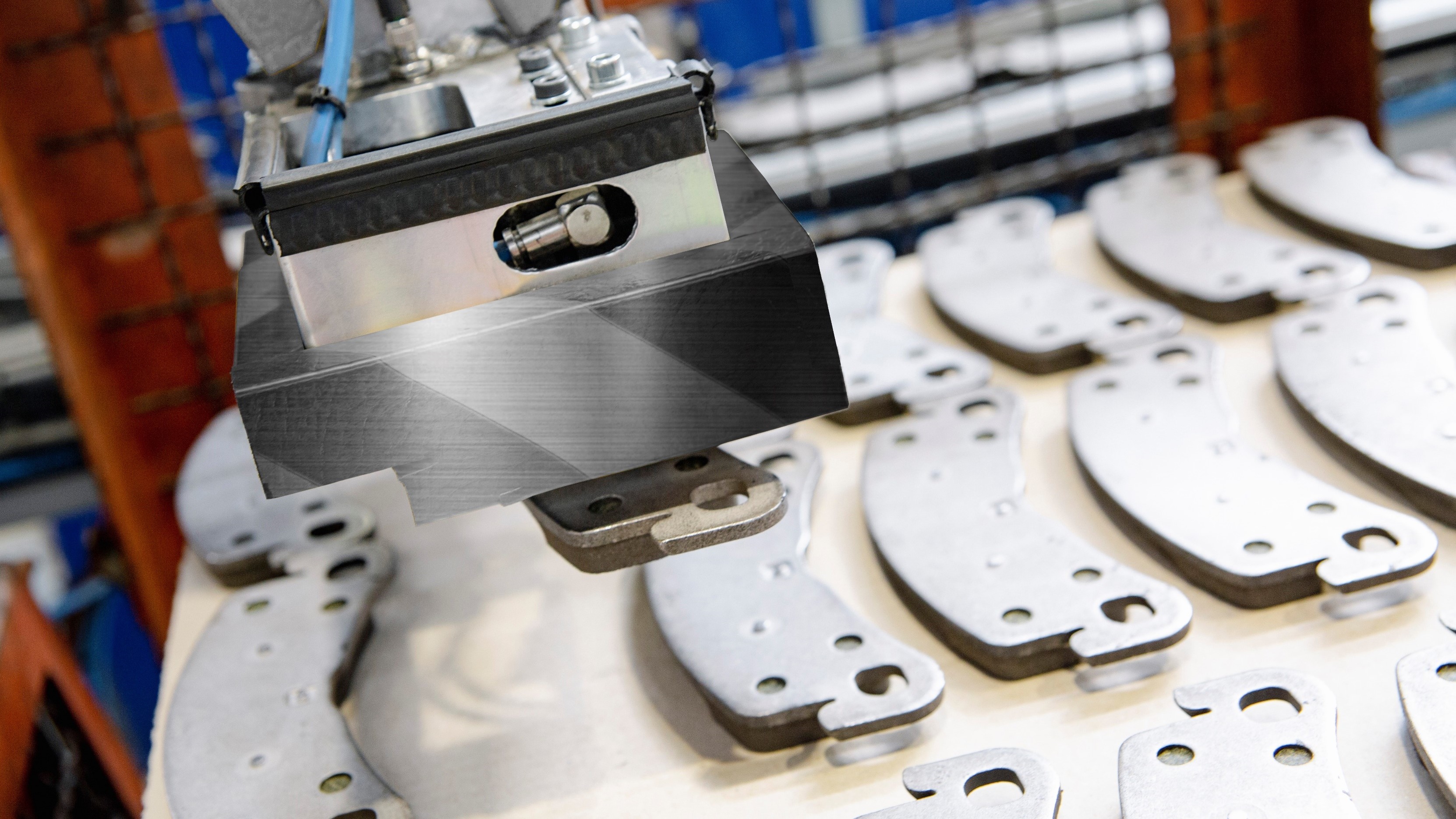

In the transportation vertical, ITT’s copper-free brake pads are leading the transition to electrified vehicles with growing content on nearly every major global OEM. The company is a global market share leader and expects that electrification will further accelerate its position. ITT’s business in this vertical has aerospace-like margins with automotive working capital performance.

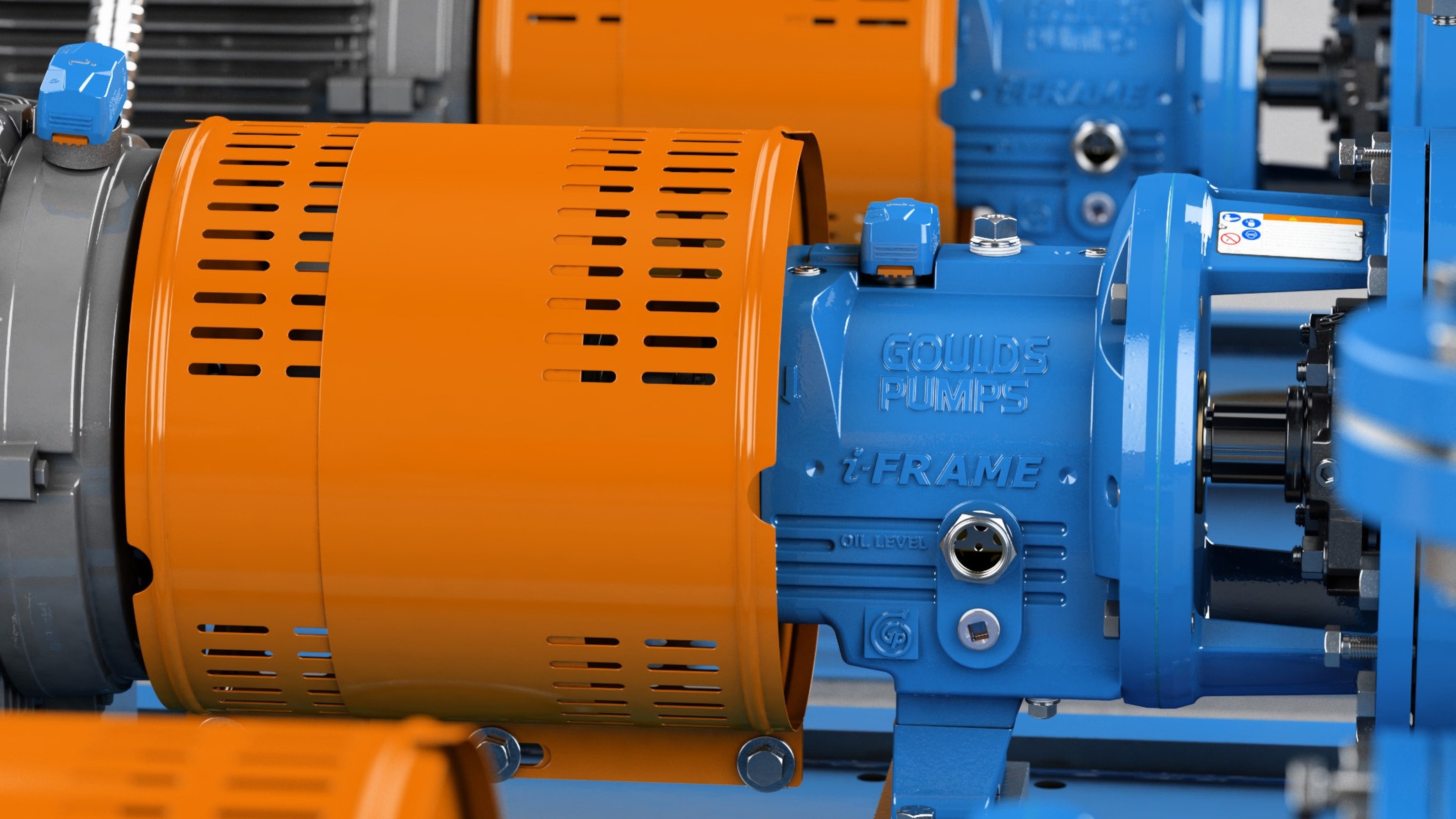

In the flow market, ITT’s iconic Goulds Pumps and engineered valves brands supply leading companies in the industrial, chemical, energy and mining industries. It has a large installed pump base and a fast lead time that generates captive aftermarket revenue streams. ITT has built a highly profitable project business and its twin-screw, multiphase pumps are a solution of choice for decarbonization projects globally.

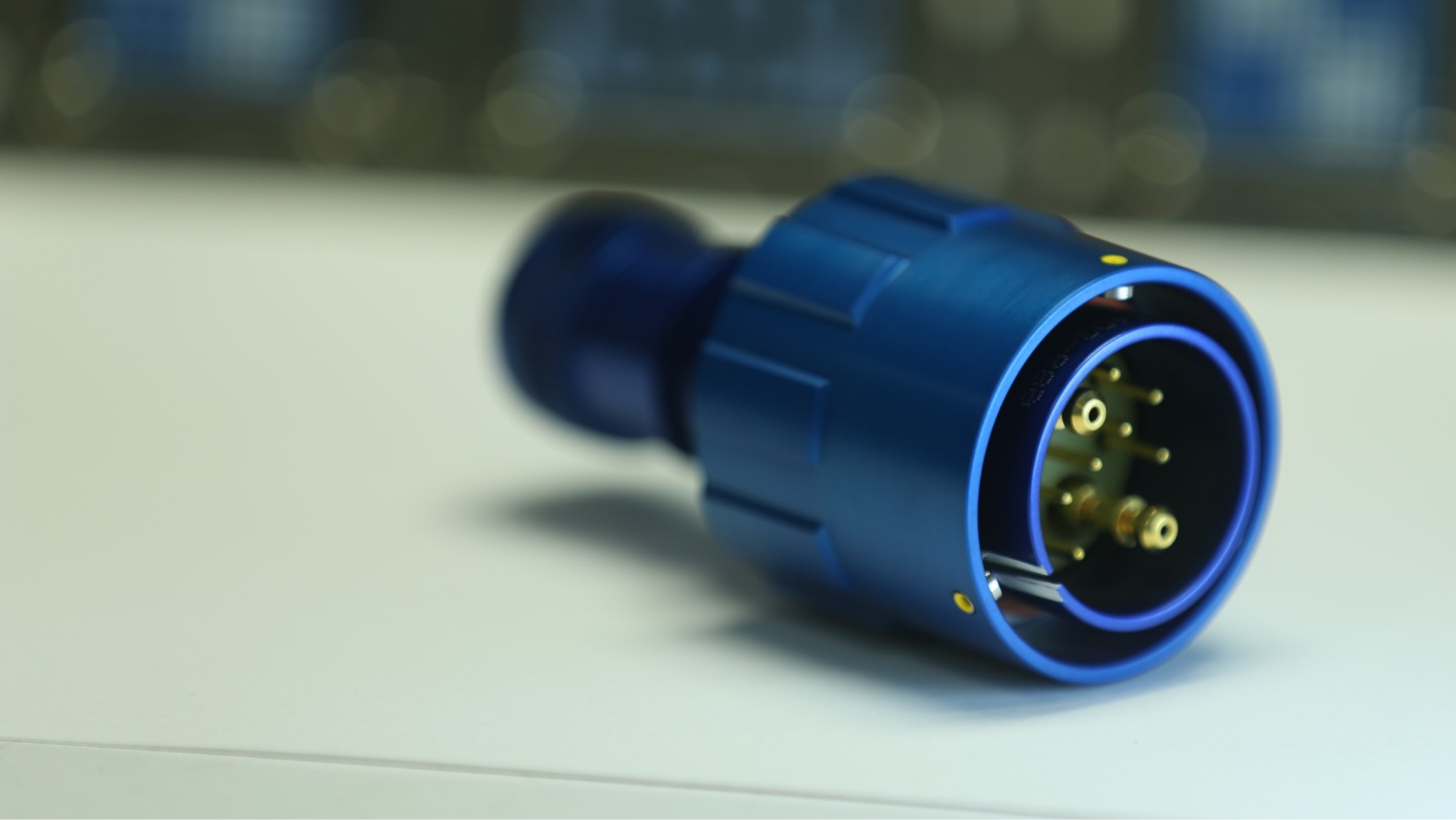

In the Aerospace and Defense markets, ITT's highly customized connectors and components provide innovative interconnect solutions and enhance the performance of military and commercial aircraft and advanced defense systems. Our solutions are also widely adopted in the medical, EV, general industrial and infrastructure markets.

Differentiation

ITT’s differentiation is sustained through a combination of several factors: execution, the quality of its leadership and a debt-free balance sheet.

The company is driving operational excellence through safety, quality, delivery and cost framework, which drives differentiation and outgrowth.

It outperforms the competition with a relentless focus on customers. As an example, ITT’s on-time performance in its brake pads business has been 99% despite supply chain challenges.

The leadership team has a granular understanding of what drives performance at ITT. CEO Luca Savi and CFO Emmanuel Caprais have led two of the company’s three businesses, which gives them first-hand knowledge about our markets, customers and products.

Lastly, ITT has a balance sheet with over two billion dollars of capacity, a backlog of more than one billion dollars and as a result, a long runway of sustainable organic and inorganic growth.